AsiaInfo, a Chinese company based in Beijing, was a systems integrator. This case study seeks to find out the best financing option available for the company.

Michael J. Roberts; Donald N. Sull

Harvard Business Review (804183-PDF-ENG)

May 04, 2004

Case questions answered:

Not the questions you were looking for? Submit your own questions & get answers.

AsiaInfo: The IPO Decision Case Answers

This case solution includes an Excel file with calculations.

Chapter 1: Introduction – AsiaInfo: The IPO Decision

1.1 Background of the Case

AsiaInfo, a Chinese company based in Beijing, was a systems integrator. AsiaInfo worked for large clients like the national phone company China Telecom. The company assembled relatively standard components, including Sun servers and Cisco routers, into Internet networks.

AsiaInfo was responsible for building the national “backbone” internet network in China and the networks in 25 of China’s 31 provinces and a fair share of the local networks. The company had built over 70% of the entire internet network in China.

AsiaInfo had participated in the internet boom in China, with its own revenues increasing from US$1.2 million in 1995 to US$44 million in 1998 and a projected US$60 million in 1999.

In this case analysis, we are trying to find out the best financing option available to AsiaInfo. Also, we will try to answer some questions included in the case.

1.2 Methodology

The report is basically based on a secondary database. All the necessary information to complete our analysis is taken from the main case of AsiaInfo. And in case of unavailability of information, we make a realistic and educated assumption based on our judgment.

1.3 Objective of the Report

Objectives of this report include:

- To analyze the current financial structure of AsiaInfo based on its operation in China.

- To review all available financing options to AsiaInfo, including IPO and Venture capital.

- To find out the best available financing strategy in terms of enterprise value and value per share of AsiaInfo.

- To answer some vital questions stated in the case.

Chapter 2: Company Profile

2.1 Company profile – AsiaInfo

AsiaInfo was established by Edward Tian and James Ding in 1993 in Texas, USA. At the initial stage, the company was focusing on putting out a newsletter over the Internet. Its core activity was collecting and providing business information on Asia to interested parties.

The firm started to translate selected topics from 120 Asian newspapers, mainly articles of interest to the business community, translating them into English and sending out a daily newsletter. By 1994, the company had 8,000 clients, including Dow Jones and Reuters.

Though the company was making a handsome amount of money in the USA, its Chinese owners (Edward Tian and James Ding) always cherished starting a business in China. In 1994, the company started to expand its activities in China as a network integrator in China’s telecommunication industry.

In late 1994, China Telecom (a state-owned telecommunication enterprise) decided to initiate a pilot project for an Internet service offering christened as “China Net.” AsiaInfo competed for and won a subcontract from Sprint to develop a portion of the China Net pilot project.

From 1995 through 1997, AsiaInfo operated primarily as a systems integrator. In 1997, however, the company began developing its own “systems software.” It was software designed to handle many of the basic and standard tasks of running any network, such as tracking usage, billing customers, and monitoring network performance.

AsiaInfo incurred a net loss of USD 382,019 in 1997 and a net income of USD 1,535,810 in 1998.

Chapter 3: Economy Analysis

3.1 Economy analysis:

Though the country (China) has a controlled economy and strong influence of state-owned enterprises, in recent times, a series of economic reforms in China have been quite helpful in stimulating the economy by encouraging agricultural development, liberalizing trade, and allowing (tightly controlled) foreign investment.

Local governments in different provinces are regularly investing in village enterprises. Rural incomes in provinces grew by 17% per year between 1978 and 1985, foreign trade was liberalized, and business firms were permitted to import without going through the central government.

In the Chinese economy, two interrelated trends have been seen: the output of non-private firms (SOEs and local and collective enterprises) is declining (100% in 1978 to 67.9% in 1996), and at the same time, private enterprise is blossoming.

Though there are still productions and import quotas and price is highly controlled, the situation has changed since 1998. Central and province-level economic development has been ensured, assisting in establishing and running a new business.

The state-owned enterprise’s monopoly had been reduced, the Chinese currency became freely convertible, and the government had started to shut down or privatize inefficient state-owned enterprises.

The Chinese government had started to invest in developing the communications infrastructure. As an outcome, the number of telephone lines grew from 6.9 million to 54.9 million (with more than 40% growth) between 1990 and 1996.

The total number of families and individuals under telephone and other communication lines had been increased. PC and Internet usage was limited but projected to grow rapidly. The present condition of this economy is quite helpful in establishing and running Telecommunication and Internet businesses.

Chapter 4: Industry Analysis

4.1 Industry analysis:

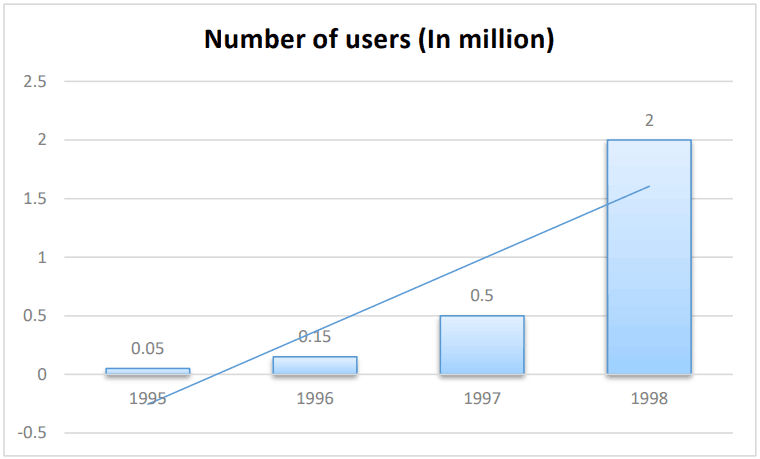

In recent years, Internet usage has become a trend in China, as the total number of internet users is increasing rapidly. In 1995, the total number of internet users was 0.5 million in 1995, which had become 2 million in 1998, increased by around 1.5 million in just 3 years.

Figure: Total number of Internet users in China (1995-1998)

China Net is considered the major service provider in China, continuously establishing a private network that has built and acquired 70% of the total market share.

It was estimated that the government itself would spend US$60 billion on telecom infrastructure during the 1996 to 2000 time frame and that Chinese corporations would spend $12 billion on their own intranet systems over the same period.

The Chinese government is focusing on increasing local and foreign investment in this sector. It was estimated that the government itself would spend US$60 billion on telecom infrastructure during the 1996 to 2000 time frame and that Chinese corporations would spend US$12 billion on their own intranet systems over the same period.

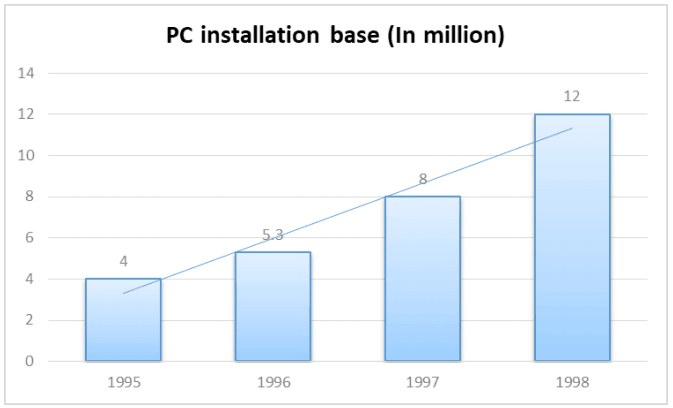

At the same time, the number of computer users has increased rapidly.

Figure: Total number of PC installation base.

4.2 Porter’s Five Forces Analysis:

Threat of new entry:

The telecommunication industry of China is controlled by…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!