This case study discusses the four potential properties that Angus Cartwright has identified for real estate acquisitions. Judy and John DeRight retained Mr. Cartwright. Both Judy and John DeRight are planning to expand their investment portfolio in the real estate industry. This case study allows students to calculate the Purchase and Operating Comparables, Breakeven Analysis, Cashflow Forecast, Financial Analysis, etc., of the four real estate properties.

Kenneth J. Hatten, William J. Poorvu, Howard H. Stevenson, Arthur I Segel, John H. Vogel

Harvard Business Review (813185-PDF-ENG)

June 10, 2013

Case questions answered:

- List of salient Facts

- First-Year Project Setup (EBIT)

- Purchase and Operating Comparables

- Breakeven Analysis

- Cashflow Forecast

- Financial Analysis

- Investment Ranking

- Percent of Total Benefits based on IRR

- Breakdown of futures

Not the questions you were looking for? Submit your own questions & get answers.

Angus Cartwright IV Case Answers

This case solution includes an Excel file with calculations.

Angus Cartwright IV Case Study Analysis

This case study discusses the four potential properties Angus Cartwright has identified for real estate acquisitions.

Judy and John DeRight retained Mr. Cartwright. Both Judy and John DeRight are planning to expand their investment portfolio in the real estate industry.

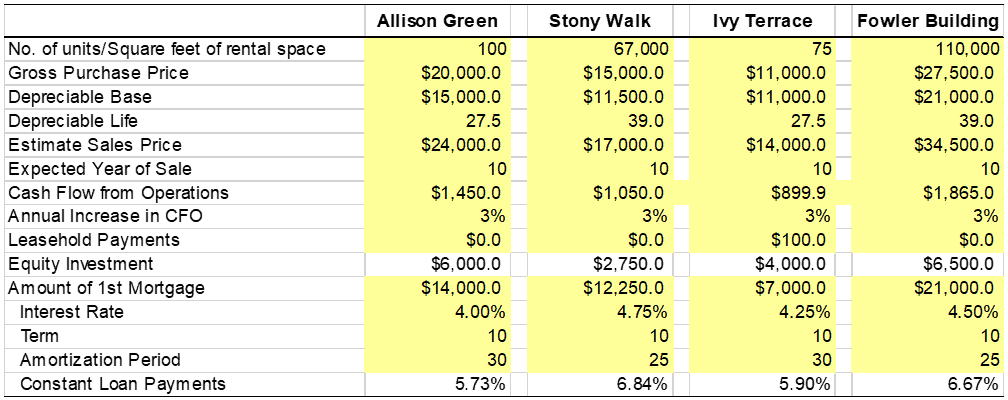

The four prospective properties are Allison Green, Stony Walk, Ivy Terrace, and Fowler Building. Mr. Cartwright is now tasked to compare and contrast the four prospective properties.

He must also provide the necessary financial calculations for the couple to render the most beneficial decision.

Case Problems:

Calculate the following for the four properties identified by Angus Cartwright:

- List of salient Facts

- First-Year Project Setup (EBIT)

- Purchase and Operating Comparables

- Breakeven Analysis

- Cashflow Forecast

- Financial Analysis

- Investment Ranking

- Percent of Total Benefits based on IRR

- Breakdown of futures

Exhibit 1 – List of Salient Facts

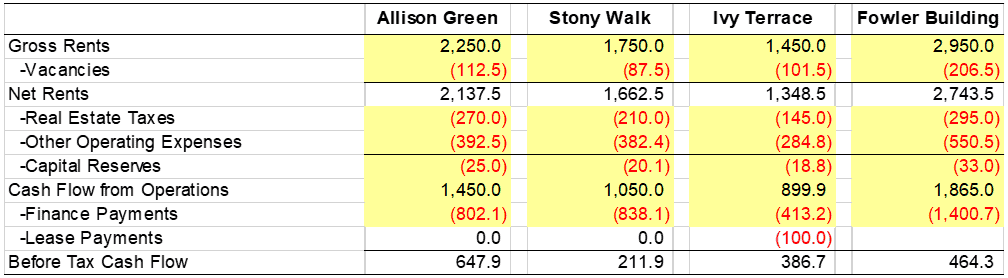

Exhibit 2 – First-Year Project Setups

Exhibit 3 – Purchase and Operating Comparables

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!